For Fund Managers

Venture Funds

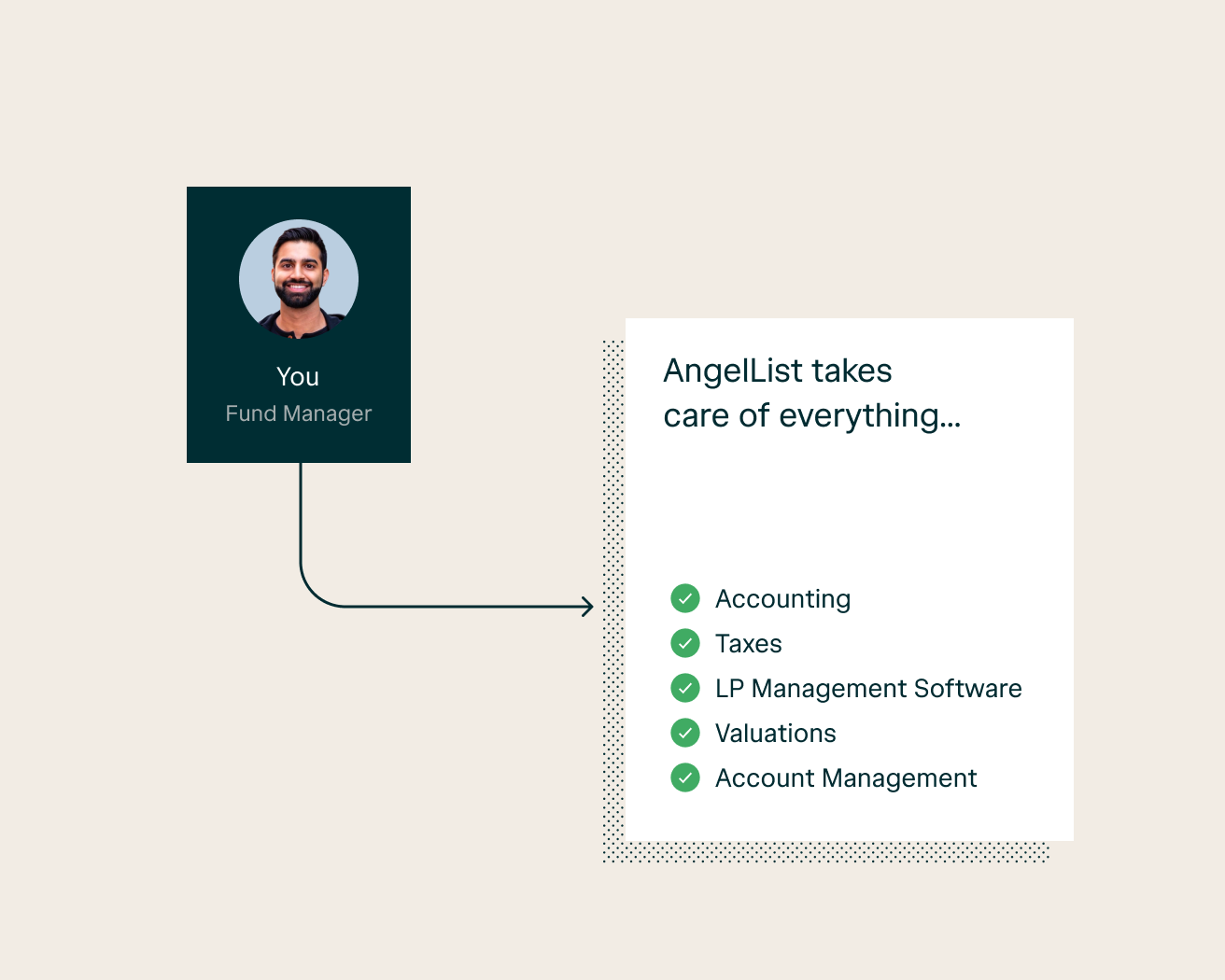

Raise capital, close deals, and manage your portfolio — all from a single platform. AngelList handles all overhead and back-office services, so you can focus on your deals.

Get startedEarn carryEarn carried interest on your investments and adjust what you share per LP.

End-to-end platformAngelList provides a streamlined platform for everything you need to run your fund.

Move quicklyRaise once, instead of deal-by-deal — so you can invest swiftly and win competitive allocations.

Everything you need to run your fund

AngelList provides a complete solution with premium service to ensure your fund runs smoothly. We handle legal formation, capital calls, tax documents, and all the other back-office services your fund needs.

Full-service fund administration

You deal with your deals. We’ll deal with the rest.

AngelList Platform Capital

Raise from professional investors on AngelList

Seamless closes

Investors close into your SPV electronically. AngelList takes care of fund formation docs and wires too

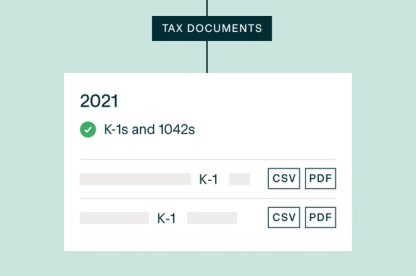

Tax preparation

We prepare tax returns and K-1 distributions for the lifetime of your investment

Pricing

Full-service fund management for funds of all stages & sizes

Base

Best for funds under $3M

$3.5k + 0.75%

of fund size

annualized cost

Investments: 15

State Regulatory Fees: Variable

Features

Fund admin

Legal fund formation

Investor closings

Transaction reviews & valuation support

Fund filing & tax services

Pricing may vary with add-on services

Core

Best for funds between $3M—$30M

$20k + 0.2%

of fund size

annualized cost

Investments: Unlimited

State Regulatory Fees: Variable

Everything in Base plus

Dedicated account manager

Unlimited investments

Pricing may vary with add-on services

Institutional

Best for funds over $30M

$35k + 0.15%

of fund size

annualized cost

Investments: Unlimited

State Regulatory Fees: Variable

Everything in Core plus

All add-on services included

Audit support

Quarterly financials

Annualized costs consist of an up front setup fee and an ongoing fund services fee over 10 years. Annualized cost assumes a 10-year fund lifetime.

FAQ

Everything you

need to know

If you’re interested in setting up a Venture Fund, click on the "Apply to lead a Fund" button above. Once you fill out the form, a team member will be in touch with you shortly.

Yes, you can adjust your fund settings. You can adjust your minimum investment amount, target fund size, target closing date, management fees, and more.

Most venture fund advisors rely on the "Venture Exemption" from investment adviser registration.

This exemption requires that no more than 20% of the fund’s aggregate capital contributions and uncalled capital commitments be invested in non-“qualifying investments”.

Common types of non-"qualifying investments" include purchases of stock in secondary sales and investments in other funds.

Capital calls on AngelList are entirely self-serve. This means you can call capital and track commitments from LPs on your own, through your fund dashboard.

Yes, you can set different minimums for different investors.